PJT Partners (PJT)·Q4 2025 Earnings Summary

PJT Partners Posts Record Year as Adjusted EPS Surges 39% — Revenue Slightly Misses

February 3, 2026 · by Fintool AI Agent

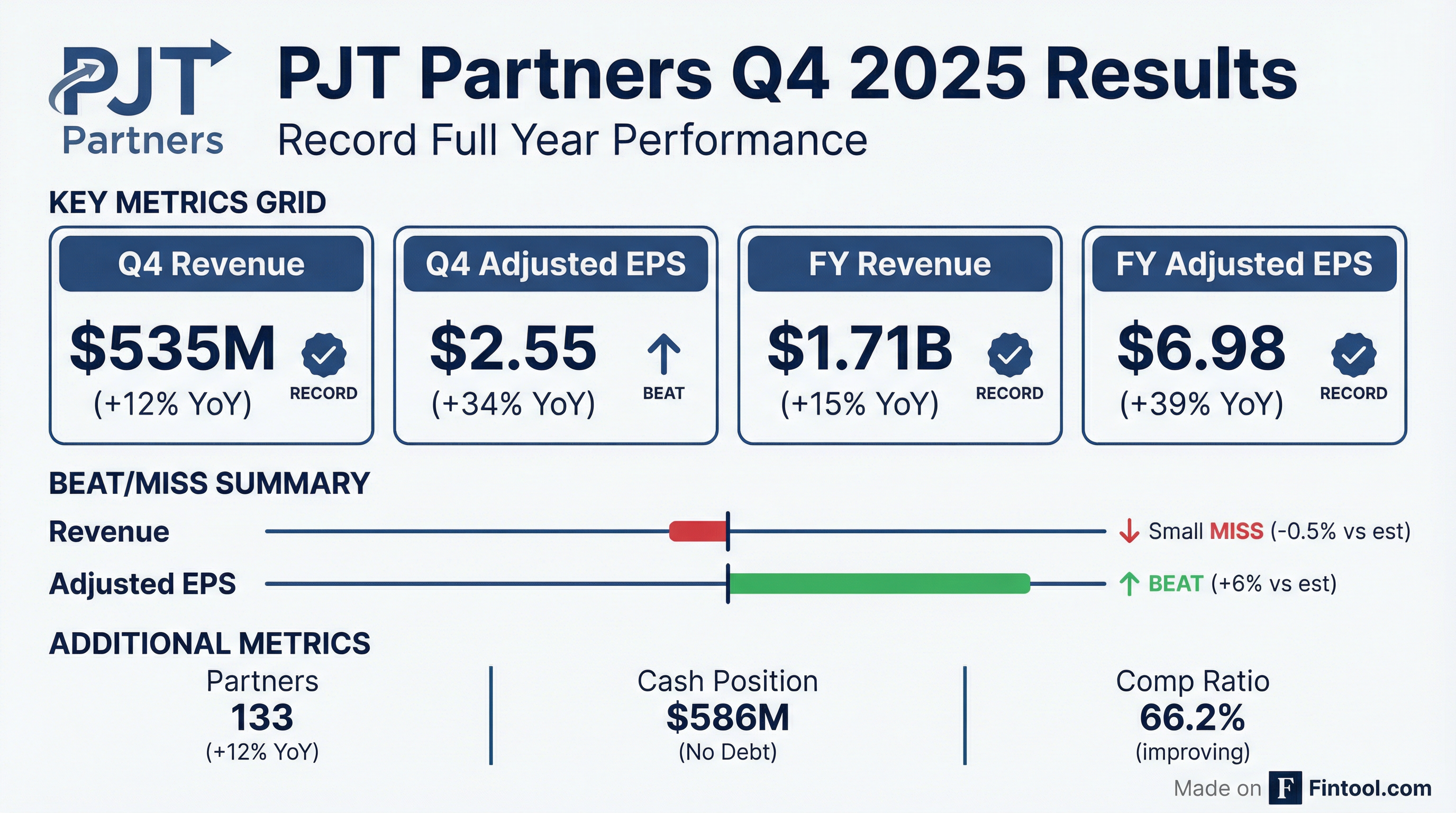

PJT Partners (NYSE: PJT) delivered record full-year results in Q4 2025, with adjusted EPS of $6.98 (+39% YoY) and revenue of $1.71 billion (+15% YoY) . The quarter saw adjusted EPS beat consensus by 6.3% while revenue came in slightly below estimates, reflecting strong operating leverage improvements despite a challenging M&A environment.

CEO Paul Taubman called 2025 "a year of record setting performance across the board," highlighting the firm's "differentiated mix of businesses" and "growth opportunities before us in each of our businesses" .

Did PJT Partners Beat Earnings?

Mixed verdict — EPS beat, revenue slight miss.

The EPS beat was driven by improving operating leverage, with the adjusted compensation ratio declining to 66.2% from 67.9% a year ago . This margin expansion helped offset the slight revenue shortfall.

Full Year 2025 — All-Time Records:

Key context: Taubman noted that firm-wide revenue is "up nearly 75% from 2021 to 2025" — despite 2021 being the "peak year for M&A activity of all time" . This underscores PJT's market share gains and platform maturation.

How Did Each Segment Perform?

PJT's two business lines showed divergent momentum:

All three businesses delivered record Q4 results. Taubman: "We had the best quarter ever in Restructuring. We had the best quarter ever in Strategic Advisory. We had the best quarter ever in PJT Park Hill" .

Advisory growth was driven by increases in both strategic advisory and restructuring revenues for the full year, with Q4 specifically benefiting from higher restructuring activity .

Placement (PJT Park Hill) surged 64% in Q4 on fund placement strength, with full-year growth of 24% across fund placement and corporate placement revenues .

What Changed From Last Quarter?

Operating leverage accelerated. The compensation ratio improved sequentially:

*Values retrieved from S&P Global

The margin improvement reflects disciplined expense management as revenues scaled. Full-year 2025 adjusted pretax margin hit 20.8%, up from 18.6% in 2024 .

Revenue reporting change: Going forward, PJT will report revenue as a single line item and no longer break out advisory, placement, and other designations. CFO Helen Meates explained that the historical placement fee line "is no longer a reasonable proxy for PJT Park Hill" given the expansion of Private Capital Solutions and corporate placement capabilities .

What Did Management Guide?

CEO Paul Taubman struck a constructive but measured tone on 2026, noting that while the M&A backdrop remains "highly constructive," market sentiment "can turn on a dime" .

Pipeline Commentary:

- Announced transaction pipeline: Comparable to year-ago levels

- Pre-announced pipeline: "Up meaningfully from a year ago and now stands near record levels"

2026 Guidance:

On the comp ratio, Taubman stated: "We thought our compensation as a percentage of revenue had peaked... I don't think we're done working it down" .

Q&A Highlights: Restructuring Outlook

The most substantive Q&A exchange focused on restructuring sustainability. Taubman was emphatic:

"We're in a multi-year period of elevated [activity]... The technological innovation is fueling our global economy, but at the same time, it's creating winners, and those winners are redefining who the losers or left-behind companies are."

Key sectors driving restructuring demand:

- Healthcare — "parts of the healthcare complex, there's a lot of pain"

- Software — "elevated focus just given events and pressures coming from AI"

- Media — "digitization and consumption of media has created significant opportunities"

- Retail — "online versus offline shopping and changing consumer behaviors"

On whether restructuring could continue growing alongside a strong M&A environment, Taubman noted: "We haven't seen any diminution... We think we're starting to see the very early signs of that growing" .

How Did the Stock React?

PJT shares dipped ~1% in after-hours trading to $172.46, down from a $174.00 close ahead of earnings. The slight revenue miss appears to have offset the strong EPS beat in investor sentiment.

Context:

- 52-week range: $119.76 - $195.62

- Stock is up ~45% from 52-week lows

- Recent pullback from January highs (~$193 on Jan 22)

The stock has been a strong performer, with PJT's business model proving resilient across market cycles. The company has grown revenue from $406M in 2015 to $1.71B in 2025, a 322% increase .

Capital Allocation and Balance Sheet

PJT maintains a fortress balance sheet with substantial capital returns:

The company also announced plans to exchange an additional 850,000 Partnership Units for cash at a price determined by the VWAP on February 5, 2026 .

Talent and Headcount

PJT continues to invest in talent acquisition, a key driver of long-term revenue growth:

Since going public in 2015, PJT has nearly tripled its partner count from 46 to 133, while employee headcount has grown from 353 to 1,224 . This investment in senior talent has been central to revenue growth.

Strategic Advisory partners with 2+ years of tenure now total 72, up from 58 a year ago, reflecting both retention and maturation of newer hires .

Partner maturation milestone: PJT enters 2026 with "the lowest percentage of partners on the platform for less than two years since you went public" per analyst Brendan O'Brien. This suggests reduced dilution from under-earning new hires and greater revenue productivity ahead .

Taubman explained the productivity curve: "Every year that those partners are on our platform, there should be greater and greater productivity... Year four is better than year three. Year five is better than year four" .

Private Capital Solutions: The Growth Engine

Taubman devoted significant Q&A time to Private Capital Solutions, calling it a secular growth opportunity:

"I do think that as an asset class, if you just look at how many new funds are being raised in secondaries... there is an increasing realization of the attractiveness of the secondary opportunity from an investment perspective."

Why secondaries are gaining favor:

- No J-Curve

- Continuity of management with known sponsors

- Specific asset identification with performance track record

- Increasingly comprised of "highest quality assets"

On PJT Park Hill's outlook: "The strength in our Private Capital Solutions business should more than offset any declines in primary fundraising" .

What to Watch Going Forward

Key catalysts and risks:

-

M&A Momentum — Taubman believes "we should be in a multi-year period of elevated deal activity" driven by regulatory tailwinds, strong capital markets, and technology-driven disruption . The pre-announced pipeline at "near record levels" supports near-term visibility.

-

Geopolitical/AI Risks — Taubman cautioned that "market sentiment can turn on a dime" with "large geopolitical risks" and "very large debates about the capital being deployed to AI, the pace of that capital deployment, [and] what the returns are" .

-

Restructuring Durability — Despite a strong M&A backdrop, restructuring demand remains elevated due to AI disruption, business model challenges, and normalized interest rates. Taubman: "We haven't seen any diminution" .

-

Margin Sustainability — The comp ratio dropped meaningfully in 2025. Taubman expects continued improvement: "I don't think we're done working it down" .

-

Talent Retention — When asked about competition for restructuring talent after a partner departure, Taubman was confident: "We believe we have the best talent. We believe we have the best culture" .

The Bottom Line

PJT Partners delivered a record 2025 with adjusted EPS up 39% and revenue up 15%, demonstrating the power of its advisory-focused model. The Q4 EPS beat (+6.3%) was offset by a slight revenue miss (-0.5%), sending shares down ~1% after hours.

With 133 partners, $586M in cash, no debt, improving margins, and a pre-announced pipeline at "near record levels," PJT enters 2026 with strong momentum. Taubman's tone was confident but measured — "we're a market share and not a market size story" — and the firm appears well-positioned to capture share whether M&A accelerates or restructuring activity persists .

View PJT Partners Research | Q4 2025 Documents | Q3 2025 Earnings